Comprehensive Forecast and Analysis: The Future of Brisbane’s Real Estate Market

Australia’s real estate market has been the subject of intense scrutiny, particularly in the wake of the pandemic and ensuing economic shifts. Brisbane, a city often overshadowed by Sydney and Melbourne, is now standing tall as a beacon of opportunity in property investment. With a unique blend of lifestyle and economic advantages, the Brisbane real estate market is poised for significant growth. This article delves into the future of Brisbane’s real estate market, including key factors driving this optimism, market predictions, and what prospective buyers or investors should consider.

Population Growth: A Pillar of Stability

Brisbane has experienced consistent population growth, particularly from interstate migration. The city’s increasing appeal is evident in its affordable living costs, high-quality education, and employment opportunities, making it a hotspot for both young professionals and families. Population growth directly correlates with housing demand, inevitably pushing property values upwards.

Robust Infrastructure: A Catalyst for Investment

Infrastructure plays a pivotal role in real estate valuation. The Brisbane City Council has been proactive in developing public infrastructure such as the Queens Wharf, Brisbane Metro, and the Cross River Rail. These projects are not only enhancing the city’s livability but are also attracting business investments. The ripple effect is a robust job market, which in turn fuels the housing sector.

The Job Market: An Unseen Hero

With a burgeoning tech scene and service sector, Brisbane is establishing itself as an employment hub. The expanding job market attracts talent, and with more people relocating, the demand for both rentals and purchases in real estate will soar. Several companies are also relocating their headquarters to Brisbane, reinforcing its reputation as a thriving economic landscape.

Current Property Values and Forecasts

The median house price in Brisbane has shown a remarkable upward trend. Recent reports suggest that we can anticipate an approximate 13% to 16% rise in property prices in the coming year. However, timing the market can be tricky. The key is to keep an eye on macroeconomic indicators such as GDP growth and interest rates, which wield considerable influence over property values.

The Impact of Interest Rates

The Reserve Bank of Australia (RBA) has maintained historically low interest rates, boosting buyer confidence. It’s a golden period for borrowers, as low rates make property investments more accessible. However, a word of caution: future rate hikes could temper the market’s fervour, making it essential to assess your long-term financial commitments.

What Does This Mean for Prospective Buyers and Investors?

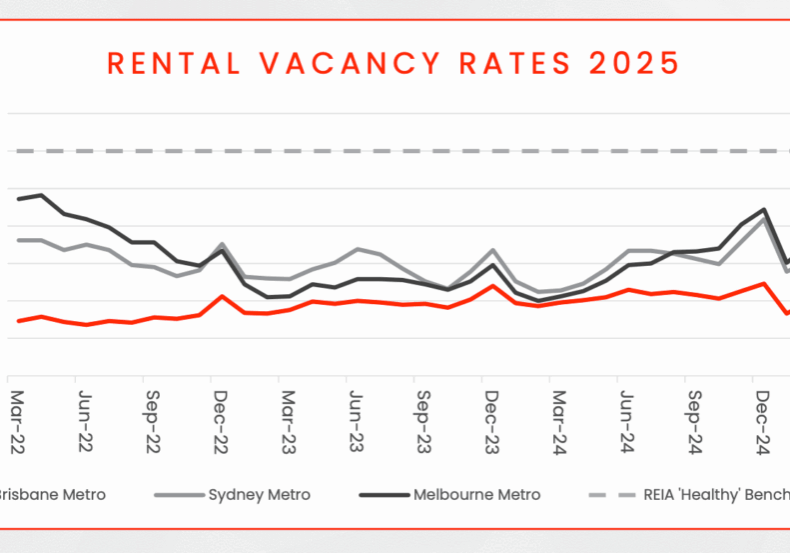

For homebuyers, now is an opportune moment to capitalise on competitive interest rates and market conditions before the predicted surge in property values. For investors, rental yields in Brisbane have been strong, offering an attractive incentive when combined with the potential for capital gains.

Conclusion

Brisbane’s real estate market offers a compelling narrative of growth and stability. As the city’s population swells, the job market diversifies, and infrastructural projects come to fruition, Brisbane is fast becoming a property investment haven. In a volatile global environment, Brisbane’s property market stands as an oasis of opportunity for both buyers and investors alike.

By offering an incisive look at the Brisbane real estate market’s driving factors, we hope this article adds significant value to your property investment journey. Take calculated risks, conduct thorough research, and you might just find that the Brisbane market is the golden goose you’ve been seeking.